There is no money on the Blockchain

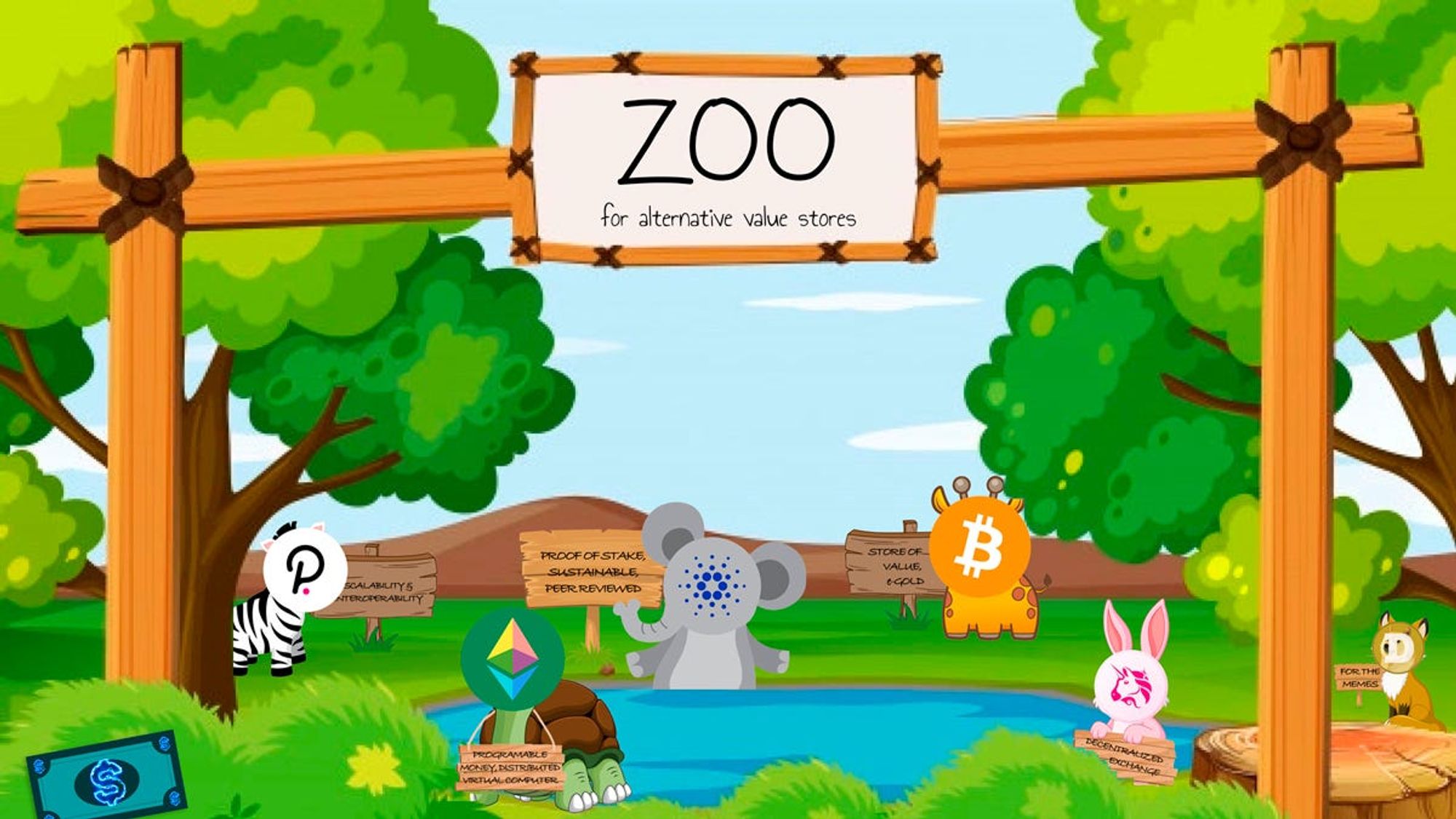

When it comes to cryptographic assets it seems as if the blockchain has birthed an entire zoo of alternative stores of value, mediums of exchange and investment vehicles, all competing against each other with their different attributes, use cases, and rationales. And, in many ways this is indeed true, however this overwhelming diversity of tokens, coins, and whatnot seems to obscure the somewhat ironic absence of the one asset the blockchain was built to facilitate: electronic cash.

The first kid on the blockchain, Bitcoin, was supposed to be just that: A Peer-to-Peer Electronic Cash System, and who knows, one day it just might make Father Satoshi proud in this way too. At the moment, however, Bitcoin can’t be called cash, or money for that matter, simply because it does not behave as money and isn’t being treated by its holders as such either. Bitcoin is a speculative asset. A very powerful one, some may say an excellent hedge against the forces of darkness, but an investment nonetheless.

And precisely because Bitcoin has proven itself to be such a good investment it is, in fact, the opposite of money. If you’re long on Bitcoin, the last thing you’re going to do with it is to spend it on groceries. This is what filthy fiat money is for. Bitcoin is for Hodling.

The same, and quite a bit more, can be said about most other cryptographic assets, which either do what Bitcoin does, just without the cheerleading. Or, more commonly, purposefully correlate themselves with the activity of a specific venture or network to serve as a proxy to its anticipated success, and as such are investment vehicles per se. Again, they are all great, more than great even, and the writer of these lines joyfully packs his attic with them periodically, but none of them are money in the true sense of the word.

And then there are of course stablecoins. Stablecoins are money, right? Sure they are; in fact, they’re simply fiat money with extra steps. They’re either digital representations of Uncle Sam’s good old USDs siloed in some trust account, or utilize other forms of collateral to artificially mimic the behaviour of the currencies they are pegged to. In that sense, stablecoins aren’t really stable, they play footsies with assets that do the stability for them.

There could be money on the Blockchain

So what then would count as actual digital cash in its own right? Well, there is a list of attributes telling you just that. Most cryptographic assets, including BTC and ETH, do check most boxes, except stability. And as we said above that’s a good thing. As a Bitcoin holder, the last thing I’m interested in at the moment is for Bitcoin to be “stable”.

However, if we’re interested in creating an actual alternative to fiat money we do need, alongside the rest of the blockchain zoo, an asset that checks all boxes, including stability. The question that naturally arises here is of course “stable in relation to what?” If we ignore fiat for a moment, and seek to design an asset that demonstrates its own inherent stability, maintained even if, god forbid, the Dollars and Euros of this world would go Weimar Republic overnight — in relation to what would it be stable?

No, not to gold. But, and this shouldn’t be a surprise, to all other goods and services offered in a given economy. Stability in this sense means the relative stability, or predictability, of prices of goods and services denominated in our hypothetical currency. You wouldn’t necessarily know how many Bitcoins, Dollars, or Euros you’ll get for one unit of such currency, but you should be able to intuit, over longer timeframes, how many bags of rice, months of rent, or hours of labour you’d be able to get in return.

For this to occur, this currency, or cryptographic asset, needs to be intimately related to the production, trade, and consumption of goods and services that can be acquired by it. It’s supply needs to always match, or at least hover around, some form of intrinsic demand exercised on it by the larger economy and be correlated with its actual growth. In other words, it should do naturally what central banks try to achieve artificially.

There will be money on the blockchain

A money supply that behaves in such a way, meaning expands and contracts as a result of the interactions of other economic variables, rather than by the decisions of a central authority or a predetermined algorithm, is called an Endogenous money supply.

The money supply of most globally trusted fiat currencies is at least partly endogenous. The supply of US Dollars and Euros, for example, expands and contracts constantly, primarily as a function of credit extended by commercial banks. Theoretically speaking, demand for credit should function as a proxy for growth, and thus be correlated with the amount of currency a given economy needs to thrive.

The problems with this system are of course ample, transfering an ungodly amount of power to financial institutions who are then in the privileged position to harness entire economies for their own objectives. However, the mathematical concept at its foundation works like clockwork. The more new businesses are being created, the more credit is extended, the more money there is in circulation to match the increasing amount of goods and services created by these new businesses. Functionally, this kind of money is by its nature valuable, since the need to repay debts exercises constant demand on it.

Could we envision a decentralized cryptographic asset, independent from central authorities — public and\or private alike — that behaves in such a way without recreating the shortcomings we normally associate with fiat currencies?

Why yes we could, and the system driving it has actually been around for quite a while. It is called Mutual Credit and it has been first thought into existence by a group of people who probably would have been Crypto enthusiasts, if they hadn’t been born 200 years before their time.

What Mutual Credit actually is and how it works has already been discussed in a previous post, but in short: instead of money being issued by banks who charge interest on loans, money arises interest free as a result of peer to peer trade activity. Instead of money being a requisite to business activity, it is a result of it. That’s seemingly a small tweak, but it changes most of what we know about money and its behaviour and is probably worthy of its own post.

The ReSource Dollar

The ReSource protocol has been designed with this idea in mind and features an international trading network that allows businesses around the world to access a credit line in a currency as the one described above.

R$, the network’s stablecoin, is minted when members in the trading network overdraft their account while trading with other members, and is destroyed when their balance returns to zero. This way, each R$ in circulation is in demand by someone who needs it to repay their debt, while its total supply expands and contracts to meet the needs of the economy it serves.

The ReSource Network launches with R$ being pegged to the US Dollar. However, the ReSource protocol, on which a multitude of different mutual credit networks may be built, offers and even suggests, the utilization of free floating mutual credit currencies. These currencies derive their stability through native market forces and retain it, irrespectively to how fiat currencies behave around it.

For this system to function smoothly, the network needs means by which it can manage risk in a distributed manner and collect uncollateralized debt globally, all without creating central points of control and failure. To learn how this is done, stay tuned for our upcoming posts.

The ReSource Team.